Online Dabba Trading App & Brokers

Save Money, Trade Smart with

ZERO BROKERAGE

Get a 3-Day Free Demo Account for Dabba Trading App!

Arrow Trade has provided high leverage, low brokerage and rapid execution in F&O, commodities, forex, NSE, MCX, NCDEX and Crypto, which ensures seamless trading.

Zero Brokerage

24/7 Deposit & Withdrawal

Upto 500x Margin

24/7 Call Support

About Dabba Trading App

Welcome to India’s Leading Dabba Trading Platform & Aap! We empower you to tailor your investment portfolio effortlessly. With access to diverse markets like stocks, cryptocurrencies, commodities, and indices, our platform makes investing simple and effective. Start customizing your financial journey today! Read more about.

Our Online Dabba Trading Services

Empowering all traders, Dabba Trading App offers a comprehensive platform with

professional tools, real-time data, and powerful analytics, all in a user-friendly interface.

Futures and Options Dabba Trading:

✔ Leverage and Flexibility: Use leverage to increase exposure with minimal capital, allowing for more dynamic trading strategies.

✔ Access to Diverse Assets: Trade across various asset classes, including indices, stocks, and commodities, to diversify risk.

✔ Lower Transaction Costs: Avoid the high brokerage fees typical of traditional F&O trading, maximizing profitability.

Commodity Dabba Trading:

✔ Access to a Variety of Commodities: Trade in metals, energy, agricultural products, and more, expanding your investment opportunities.

✔ Reduced Brokerage and Compliance Fees: Engage in commodity trading with lower fees, keeping more profits in your pocket.

✔ Leverage for Enhanced Returns: Utilize leverage to maximize exposure and amplify potential returns in commodity markets.

Read more >

Margin Dabba Trading:

✔ Maximize Market Exposure: Trade larger positions with lower initial capital, making full use of margin facilities to enhance profits.

✔ Reduced Regulatory Burdens: Operate with fewer compliance requirements, minimizing time and costs associated with regulatory procedures.

✔ Increased Liquidity: Gain access to a highly liquid trading environment, allowing for swift entry and exit from positions.

FOREX Dabba Trading:

✔ Global Currency Access: Trade various international currency pairs, allowing you to take advantage of global market trends.

✔ Minimal Overhead Costs: Save on high fees and hidden charges associated with traditional FOREX trading platforms.

✔ High Leverage Options: Utilize leverage to multiply your potential returns, catering to both small and large-scale traders.

CRYPTO Dabba Trading

✔ Low Entry Fees: Enter the cryptocurrency market with minimal trading fees, optimizing profit margins.

✔ Trade Multiple Cryptocurrencies: Access various digital assets beyond Bitcoin, such as Ethereum, Litecoin, and more, broadening your trading options.

✔ High Leverage Opportunities: Amplify your market exposure with flexible leverage options tailored to crypto trading

Intraday Dabba Trading:

✔ Fast Trade Execution: Execute trades instantly, capitalizing on short-term market movements for quick gains.

✔ Low Transaction Costs: Benefit from minimal brokerage fees, allowing for more frequent trades and higher profit potential.

✔ High Leverage Options: Use leverage to boost your trading power, maximizing returns on intraday strategies.

Why Dabba Trading App?

Empowering all traders, Dabba Trading App offers a comprehensive platform with

professional tools, real-time data, and powerful analytics, all in a user-friendly interface.

Simple, Fast Trading Experience

Enjoy quick and hassle-free trading with real-time market insights and seamless updates that keep you ahead of the curve.

Register in Just 10 Seconds

Create your account in under 10 seconds with our automated wallet system and start trading instantly—no delays, just action.

24/7 Customer Support

Our friendly and expert team is available 24/7 to assist you through WhatsApp, ensuring you have the support you need, anytime, anywhere.

Open Your Demat

Sign up for an account on the DTA trading platform.

Open Your Demat

Sign up for an account on the DTA trading platform.

Open Your Demat

Sign up for an account on the DTA trading platform.

24*7 Support of Dabba Trading Brokers

Our round-the-clock customer support guarantees you always have assistance whenever you need it, ensuring your deposits and withdrawals are processed seamlessly and efficiently.

Open Account in Just 1 Minute and Start Trading

Open Your Demat

Sign up for an account on the Arrow trade

Less Documents

Submit the required documents to verify your identity

Deposit Funds

Add money to your trading account

Start Trading

Begin executing trades on the platform.

Who We Are?

At DABBA TRADING, we believe in making investing simple and effective. Our mission is to help you build wealth by strategically allocating resources for long-term growth.

Commitment to Growth

We are committed to your success, guiding you with expert insights and a variety of options to maximize your financial growth potential.

Effortless Experience

We offer a streamlined investing process with minimal paperwork and no KYC requirements, making it quick and easy for you to get started.

Customer-First Support

Your satisfaction is our priority. Benefit from fast payouts, flexible withdrawal options, and dedicated support to ensure your investment journey is smooth and rewarding.

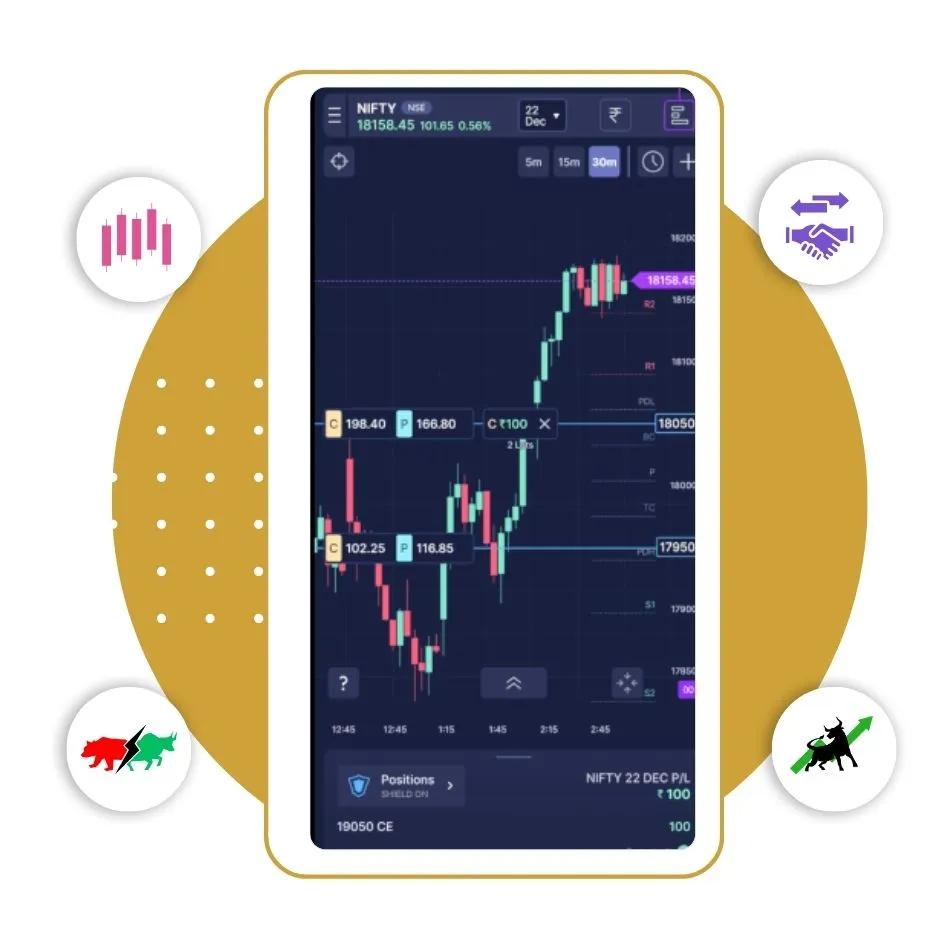

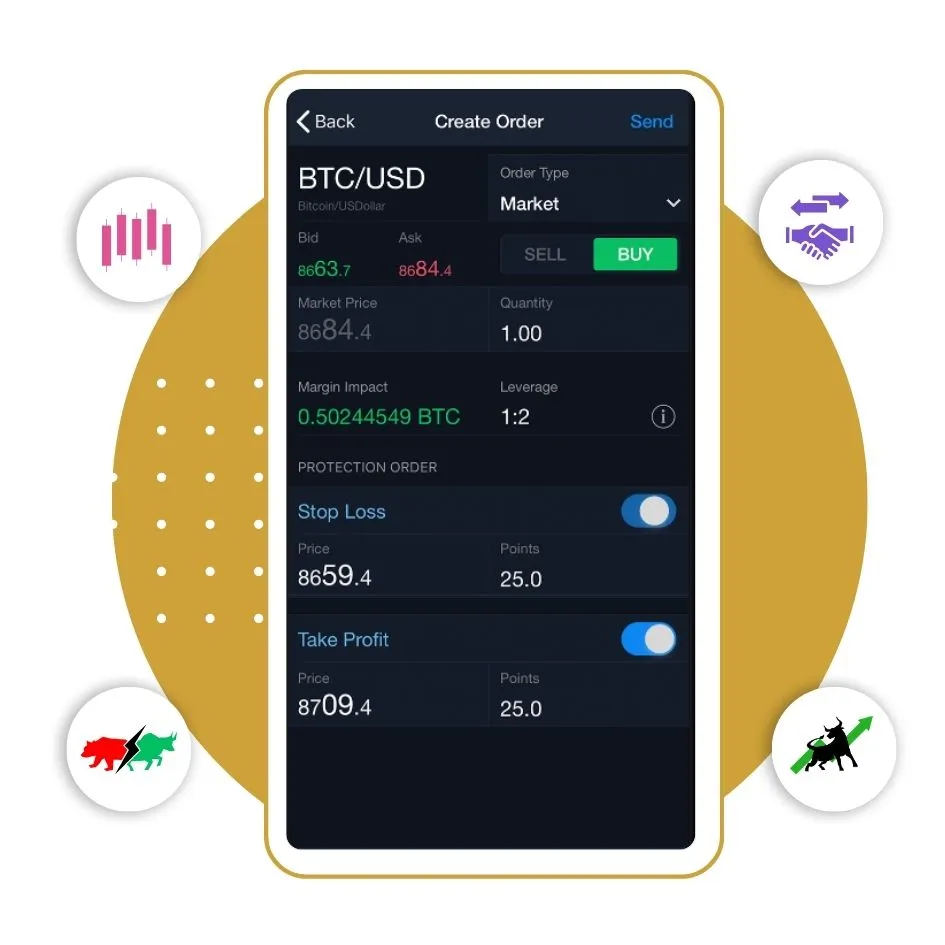

Download The Dabba Trading App

For iOS and Android Today!

Welcome to download our brand new Dabba Trading app for your iPhone, Android smartphone, or use the desktop mode for a seamless experience. Our app offers the best online trading platform, allowing you to place trades and manage your portfolio from the comfort of your home.

Our app features bank-grade security for safe and fast payment gateways, ensuring your transactions are protected at every step. Simply select the trading services you need, add them to your cart, enter your details, and complete the payment process—we’ll handle the rest.

With real-time market data, personalized alerts, and a user-friendly interface, you can stay ahead of the market wherever you are, on any device.

Reviews About Dabba Trading App

Empowering all traders, Dabba Trading App offers a comprehensive platform with

professional tools, real-time data, and powerful analytics, all in a user-friendly interface.

Mohan

NSE Futures & Options

Rahul

MCX Futures & Options

मैंने एमसीएक्स पर वायदा और विकल्प ट्रेडिंग का अनुभव लिया और यह वाकई शानदार था। यह प्लेटफॉर्म न केवल सुरक्षित और भरोसेमंद है, बल्कि कमोडिटी बाजार में नए अवसरों को खोजने का एक बेहतरीन तरीका भी है।

Rohan

Global Markets

वैश्विक बाजारों में अलग-अलग ट्रेडिंग अवसरों के साथ अपने निवेश के विकल्प बढ़ाएं और नए मौके तलाशें

Rockey

Commodity Futures

Vivek

Forex Trading

Akash

Forex Trading

Participate in forex trading with attractive spreads and access to real-time market insights.

FAQ's About Online Dabba Trading

Investing at DABBA TRADING is all about making smart choices to grow your wealth. We provide opportunities to strategically manage your funds and create a brighter financial future.

Download the Arrow Trad app from our website, create your account in a few easy steps, and deposit funds securely. Once your account is set up, you can immediately begin trading through the app.

The Dabba Trading app offers a diverse range of assets including stocks, commodities, currencies, NSE, MCX, Forex, Comex, Global Trading, Live Trading, and Online Dabba Trading. Check the app for the full list of available trading options.

Yes, we prioritize the safety of your funds. Our app uses advanced security measures and encryption protocols to protect your investments and personal information.

Visit the withdrawal section in the app, choose your preferred payment method, and follow the instructions. Withdrawals are processed quickly, usually within minutes, for your convenience.

The Dabba Trading app offers a zero-fee policy for transactions, deposits, and withdrawals, ensuring you maximize your earnings.

Yes, you can access the app and trade from anywhere at any time, as long as you have an internet connection. Trade seamlessly, whether you’re at home or on the go.

We provide 24/7 customer support through various channels, including WhatsApp, to assist with any issues or questions you may have about your account or trades.

Yes, we offer a demo account for new users. This feature allows you to practice trading with virtual funds, helping you become familiar with the platform and build confidence before investing real money.

If you notice any suspicious activity, contact our customer support team immediately. We take such matters seriously and will work promptly to address any concerns and ensure your account’s security.

Trading hours typically align with global and regional market times, but may vary depending on the asset. Check the app for the specific trading hours for each market to plan your trades accordingly.

What Is Dabba Trading in India?

Dabba trading, also known as “Box trading” or Dabba Trading App is an informal method of trading that bypasses official exchanges such as NSE or BSE. Although banned by the Securities Exchange Board of India (Sebi), it still attracts traders. that seek high leverage faster debt repayment and minimum transaction costs.

This form of trading works through intermediaries called Best Dabba Brokers in India, which handle transactions privately. Traders avoid standard brokerage fees and taxes. This makes it possible to trade interesting but unconventional options.

How Does Dabba Trading Work?

The can trade involves transactions outside of the official exchange. The broker simulates real-time market prices and executes trades privately.

Here’s how it works:

- Traders speculate on stock price movements. Commodities or currencies

- The broker records the trade and pays profit or loss based on the price difference.

- Debt repayments are generally made in cash or through informal channels. without any legal documents.

This method is often preferred because of its speed and flexibility. It allows traders to circumvent regulations and take advantage of market fluctuations.

Advantages of Dabba Trading Aap:-

Dabba Trading Platform provides several benefits for traders looking for faster and more cost-effective alternatives to regulated markets:

- Zero Brokerage Charges

Eliminates the need to pay traditional brokerage charges, increasing profitability. - Higher Leverage

Provides adequate leverage such as 500X for intraday trading and 60X for carryover trading. which promotes profit potential - Quick Settlement

Trades are settled quickly. Often it takes hours or a day. Compared to the official market cycle. - NO Documentation

Only basic documents are required. This helps streamline the onboarding process for sellers.

-

Only basic Documents:-

Name:-

Number:-

City:-

Gmail:- - Private and flexible business

Operate without restrictions on regulated exchanges Provides greater flexibility and discretion.

Is Dabba Trading Aap Profitable?

Dabba trading offers the opportunity to earn quick profits by taking advantage of small price movements in the market. Its cost-effective and flexible structure makes it attractive to experienced traders.

However, the potential for fraud by brokers highlights the need for caution. To achieve profitability in this system It is important to ensure transparency and choose an ethical intermediary.

Conclusion

Trading can be a profitable and efficient method of trading for those who want high leverage and low costs. However, traders should be careful to avoid fraudulent behavior and ensure that they are dealing with a reliable broker.

Taking a disciplined approach and working with ethical practitioners is Essential for long-term success. Although the canning business exists in a gray area of legality, But understanding the complexities of a business can help a business make informed decisions.